The Social Security Administration’s life expectancy tables offer crucial insights for people planning for their retirement. These tables provide an estimate of how long someone is expected to live, and this information can be useful when considering Social Security benefits. The life expectancy tables take into account various factors such as age, sex, and race, and provide accurate predictions on when someone can expect to reach certain milestones in their lives.

The life expectancy calculator for Social Security benefits is a valuable tool for anyone looking to plan for their retirement. With this calculator, people can estimate how long they will be able to receive Social Security benefits based on their life expectancy. This information can help individuals decide when to begin taking benefits and how to adjust their investment plans accordingly.

Overall, understanding life expectancy and how it affects Social Security benefits is crucial for anyone planning for their future. Whether planning for retirement or disability benefits, it is important to have an accurate estimation of how long you can expect to live, and the associated benefits you are entitled to receive. The Social Security Administration’s mortality tables and life expectancy formulas provide a reliable guide for those planning for their future.

Life Expectancy Calculator for Social Security Benefits

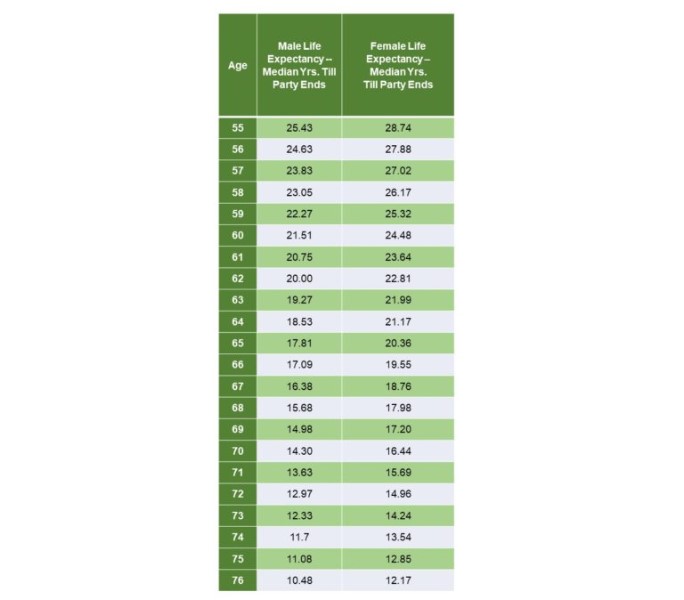

For those planning their retirement, it’s essential to know how long they are likely to live. Social Security life expectancy tables and calculators can help individuals estimate their life expectancy, which in turn determines the amount of benefits they can receive.

One tool that can be used is the Social Security life expectancy calculator. This calculator takes into account the individual’s age, gender, and other factors to provide an estimate of their life expectancy. The results of the calculator can help individuals make important decisions about their retirement planning, including when to start claiming Social Security benefits.

It’s important to note that while life expectancy calculators are useful tools, they should not be considered definitive. There are many factors that can impact an individual’s lifespan, including genetics, lifestyle, and medical history. However, these calculators can provide a helpful starting point for retirement planning and can allow individuals to make informed decisions about their financial future.

Overall, the use of Social Security life expectancy calculators can be an important part of retirement planning. By understanding life expectancy, individuals can make informed decisions about when to retire, when to claim Social Security benefits, and how much they need to save for the future.

Social Security life expectancy by birth year

Section 3 of this table of contents provides information on Social Security life expectancy by birth year. Knowing your life expectancy can help you plan for retirement and make informed decisions about your Social Security benefits. The Social Security Administration provides life expectancy tables and calculators to help you estimate your life expectancy. By understanding your life expectancy, you can develop a retirement plan that meets your needs and ensures a stable income throughout your retirement years.

Social Security life expectancy formula

The Social Security life expectancy formula is an important factor for those planning their retirement. Here are some points to consider:

The formula: The Social Security Administration (SSA) uses a formula to calculate life expectancy based on your birth year. This is called the period life expectancy.

Factors that affect the formula: The formula takes into account factors such as mortality rates, trends, and how long people are expected to live in the future.

How to use the formula: The formula can be used to estimate your life expectancy and plan for your retirement. You can use the SSA’s life expectancy tables to find your period life expectancy.

Keep in mind: The life expectancy formula is just an estimate and does not guarantee how long you will live. Additionally, the formula does not take into account personal lifestyle factors such as smoking, exercise, or diet. It is important to consider these factors when planning for your retirement.

- Use the Social Security life expectancy formula to estimate your period life expectancy.

- Consider personal lifestyle factors when planning for retirement.

- Understand that the life expectancy formula is just an estimate and does not guarantee how long you will live.

By understanding the Social Security life expectancy formula and considering other factors, you can better plan for a secure and comfortable retirement.

Social Security life expectancy for retirement planning

Section 5 of the table of contents discusses the importance of social security life expectancy for retirement planning. Knowing your life expectancy is crucial when planning your retirement, as it can help you estimate the amount of time you will need to support yourself financially. The Social Security Administration provides life expectancy tables and a calculator that can help you estimate your lifespan and plan accordingly.

It’s important to note that the life expectancy tables provided by the SSA are just estimates. Factors such as genetics, lifestyle, and overall health can all contribute to an individual’s actual lifespan. However, having an estimate from the SSA can still be a valuable tool for retirement planning.

In addition to life expectancy for retirement planning, the table of contents also includes information on life expectancy for social security disability benefits, survivor benefits, spousal benefits, and more. By understanding the life expectancy tables and formulas provided by the SSA, individuals can better plan for their future financial needs.

Response to Section 6: Social Security Administration Mortality Tables

Section 6 of the table of contents focuses on the Social Security Administration mortality tables. These tables are essential in determining life expectancy, which is a crucial factor for retirement planning and Social Security benefits eligibility.

The Social Security Administration mortality tables are updated every year to reflect the latest mortality rates. These tables provide information on the probability of death at each age, race, and sex. The tables also include life expectancy figures for various age groups, which are used to calculate benefits for survivors and spouses.

Understanding the mortality tables is crucial for retirement planning and Social Security benefits eligibility. By using these tables, individuals can estimate their life expectancy and plan accordingly for their retirement. Additionally, these tables are used to calculate benefits for survivors, dependents, and spouses, making them an essential resource for those who rely on Social Security.

Overall, the Social Security Administration mortality tables are a vital tool for those planning their retirement and calculating Social Security benefits eligibility. By using these tables, individuals can make informed decisions about their retirement planning and ensure they receive the benefits they are entitled to.

Life Expectancy Tables for Social Security Disability Benefits

Section 7 of the table of contents deals with life expectancy tables for Social Security disability benefits, which provide valuable information about how long a person is expected to live with a disability. These tables are used to determine the duration of disability benefits and to inform decisions about disability insurance.

The Social Security Administration maintains detailed life expectancy tables that take into account a variety of factors, including age, gender, and medical history. These tables can help individuals with disabilities plan for their financial future and make informed decisions about their health care.

If you are disabled and seeking Social Security disability benefits or looking to plan for your future, it is essential to understand the life expectancy tables that apply to your situation. By doing so, you can make informed decisions about your disability insurance and ensure that you have the resources you need to live a fulfilling and financially secure life.

Life Expectancy Tables for Social Security Survivor Benefits

Section 8 of the table of contents lists the life expectancy tables that are relevant to Social Security survivor benefits. These tables are crucial for determining the duration and amount of benefits a beneficiary can receive. It is important to note that these tables are based on statistical averages and may not apply to every individual circumstance. However, they provide valuable guidance for both beneficiaries and Social Security administration staff.

- Social Security Administration mortality tables: These tables provide information on the likelihood of a person’s death at different ages and are used to calculate life expectancy.

- Life expectancy tables for Social Security disability benefits: These tables are used to determine the duration of disability benefits based on life expectancy.

- Social Security life expectancy for spousal benefits: Similar to survivor benefits, these tables provide guidance on the duration and amount of benefits a spouse can receive after the death of their partner.

Overall, understanding these life expectancy tables and how they are used by Social Security administration is crucial for making informed decisions about retirement planning, disability benefits, and survivor benefits.

Lifeline Necklace FAQ

Here are some frequently asked questions about the Lifeline necklace:

- What is the Lifeline necklace and how does it work?

- How do I set up my Lifeline necklace?

- Can I wear my Lifeline necklace in the shower or pool?

- What should I do if I accidentally press the button on my Lifeline necklace?

- How far away from the base unit can I be with my Lifeline necklace?

- What happens if the power goes out and I need to use my Lifeline necklace?

- How often should I test my Lifeline necklace to make sure it is working?

- What happens if I move and need to update my Lifeline account?

If you have additional questions that are not answered here, please contact us using one of the methods listed in the table of contents.

Social Security life expectancy for divorced spouses

When it comes to Social Security benefits, divorced spouses may be entitled to a portion of their ex-spouse’s benefits. The life expectancy of the ex-spouse is an important factor in determining the benefits amount. The Social Security Administration provides life expectancy tables that can be used to calculate benefits for divorced spouses. It’s important to note that the amount received will also depend on the ex-spouse’s work history and the duration of the marriage. Understanding life expectancy and how it impacts Social Security benefits can be a complex process, but it’s crucial for divorced spouses to do their research and make informed decisions.

Response to Section 11: Lifeline Necklace Warranty

The Lifeline necklace is an essential tool for ensuring the safety of vulnerable individuals. As with any other product, there is always a possibility of malfunction or defects, and that is why a warranty is crucial. The Lifeline necklace comes with a manufacturer’s warranty that provides assurance to the user in case of defects or malfunctions.

The Lifeline necklace warranty covers repairs or replacement of the device at no additional cost if the product experiences any defects in workmanship or materials under normal use. It is essential to note that the warranty does not cover damages caused by misuse or tampering with the device.

To enjoy the Lifeline necklace warranty, you should ensure you purchase from a reputable vendor and register the device. All Lifeline necklaces come with instructions on how to register your device.

In case you experience any issues with the Lifeline necklace, the first thing you should do is contact customer support. The support team will guide you through troubleshooting, and if they determine that the issue warrants warranty service, they will initiate the process.

In conclusion, the Lifeline necklace warranty is a crucial component for ensuring the effectiveness and reliability of the device. Users should register their devices and reach out to customer support in case of any issues.

Response to Section 12: Medicare Life Expectancy Tables for Social Security Eligibility

Section 12 of the table of contents refers to the Medicare life expectancy tables for Social Security eligibility. Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). Social Security eligibility is required in order to enroll in Medicare, and life expectancy plays a role in determining when a person can enroll.

The Medicare life expectancy tables take into account factors such as sex, smoking status, and current health status to estimate a person’s life expectancy. This estimation is important for determining when a person is eligible for Medicare and for predicting their future healthcare needs.

It’s important to note that life expectancy is just an estimation and not a guarantee. Many factors can impact a person’s life expectancy, including genetics, lifestyle choices, and access to healthcare. However, these tables can be a helpful tool for retirement planning and understanding Medicare eligibility.

In summary, the Medicare life expectancy tables for Social Security eligibility can be an important resource for those approaching retirement age and considering their healthcare options. It’s important to keep in mind that these estimations are not set in stone and to work with a healthcare provider to determine your individual healthcare needs.

Lifeline Necklace Repair

If your lifeline necklace is not functioning properly, it may be time to consider repairs. Lifeline necklace repair services can help bring your device back to working order, ensuring that you have access to emergency assistance when you need it most.

When seeking repair services, be sure to check the manufacturer’s warranty information, as some issues may be covered under warranty. You can also contact Lifeline necklace support for assistance with troubleshooting and determining the best course of action to address any issues you may be experiencing with your device.

In addition, be sure to follow proper maintenance procedures to help extend the life of your lifeline necklace and prevent the need for repairs in the future. This may include regular cleaning and inspection of the device, as well as proper storage and handling.

Overall, whether you’re in need of repairs or simply want to ensure that your lifeline necklace is functioning properly, there are a variety of resources available to help. Don’t hesitate to reach out to Lifeline necklace support or repair services for assistance as needed.