Choosing the right healthcare coverage plan can be a daunting task, especially when you are not familiar with the differences between Medicaid and Medicare. Section 1 of the table of contents provides valuable information to help you understand these two programs.

Medicaid is a government program that provides healthcare coverage to low-income individuals and families. On the other hand, Medicare is a program that provides healthcare coverage to people over the age of 65 or those with certain disabilities. While both programs aim to provide healthcare coverage to eligible individuals, they differ in terms of eligibility requirements, benefits, and costs. Medicaid is funded by both the federal government and individual states, while Medicare is solely funded by the federal government.

By understanding the difference between Medicaid and Medicare, you can make an informed decision when choosing between Ambetter Medicaid and Medicare plans. Ambetter is a healthcare insurance provider that offers both Medicaid and Medicare plans to eligible individuals. While Ambetter Medicaid plans offer benefits such as hospitalization, preventive care, and prescription coverage, Ambetter Medicare plans offer additional benefits such as dental, vision, and hearing coverage.

In conclusion, choosing the right healthcare coverage plan requires careful consideration and understanding of the available options. With the help of the information in section 1, you can make the right choice between Ambetter Medicaid and Medicare plans based on your healthcare needs and budget. Don’t hesitate to seek assistance from a licensed insurance agent or healthcare provider to guide you through the process.

What is Ambetter Insurance?

Ambetter is a health insurance plan offered by Centene Corporation. It provides coverage options for individuals, families, and seniors. Ambetter offers both Medicaid and Medicare plans in select states throughout the US. The plans include comprehensive medical, dental, and vision coverage. Ambetter is known for its affordability, and its plans are particularly beneficial for those who may not be eligible for insurance through their employer. Additionally, Ambetter offers a variety of tools and resources to help members manage their health and wellbeing. If you are looking for a health insurance plan that offers comprehensive coverage at an affordable price, then Ambetter may be the right choice for you.

Is Ambetter a Medicaid Plan?

Yes, Ambetter offers Medicaid plans in certain states. In fact, Ambetter is one of the largest Medicaid insurers in the country. These plans are designed to provide low-cost health coverage to individuals and families with low incomes or disabilities. Ambetter Medicaid plans vary by state, so it’s important to check what is available in your area. Some plans may offer additional benefits such as dental and vision care, transportation, and wellness programs. To apply for an Ambetter Medicaid plan, you will need to check your eligibility and submit an application through your state’s Medicaid agency or healthcare.gov.

Ambetter Medicaid: Everything You Need to Know

Ambetter Medicaid is a health insurance plan that provides coverage to eligible individuals with low income. It is a part of the Medicaid program, which is a joint federal and state program that helps people with limited income and resources pay for their healthcare.

Ambetter Medicaid offers a range of benefits, including doctor visits, hospital stays, prescription drugs, and more. The exact benefits vary from state to state, so it’s important to check the specific details in your area.

To be eligible for Ambetter Medicaid, you must meet certain income and other criteria set by your state. You can apply for Medicaid through your state’s Medicaid agency or through the healthcare exchange website.

If you’re trying to decide between Ambetter Medicaid and Medicare, it’s important to understand the differences between the two programs. Medicare is a federal program that provides health insurance for people over 65, as well as people with certain disabilities and health conditions.

Ultimately, the choice between Ambetter Medicaid and Medicare will depend on your individual circumstances and healthcare needs. It’s important to carefully consider your options and talk to a healthcare professional if you have questions.

Ambetter vs Medicare: Which Insurance is Right for You?

When it comes to choosing between Ambetter and Medicare, it’s important to understand the key differences between the two. Ambetter is a private insurance provider that offers plans on the Health Insurance Marketplace, including Medicaid plans. Medicare, on the other hand, is a federal insurance program for people over the age of 65, as well as those with certain disabilities or health conditions.

If you’re eligible for both Medicaid and Medicare, you may be able to enroll in a Medicare Advantage plan through Ambetter. These plans offer additional benefits and may have lower out-of-pocket costs compared to original Medicare. However, it’s important to carefully compare your options and consider factors like provider networks, prescription drug coverage, and costs before making a decision.

If you’re not eligible for Medicare, Ambetter may be a good option for comprehensive health coverage. Ambetter plans typically offer a range of benefits, including preventative care, prescription drug coverage, and mental health services. You can browse Ambetter plans and pricing for Medicaid on the Health Insurance Marketplace.

Ultimately, the choice between Ambetter and Medicare depends on your individual healthcare needs and financial situation. It’s important to carefully research and compare your options to make an informed decision.

How to Enroll in Medicare

Enrolling in Medicare can be a complex process, but it is essential for those who are eligible and in need of healthcare coverage. To enroll in Medicare, you must first determine your eligibility by meeting certain criteria. This includes being age 65 or older, having a disability, or having end-stage renal disease. Once you have confirmed your eligibility, you can enroll in Original Medicare through the Social Security Administration website or by calling their toll-free number. You may also choose to enroll in a Medicare Advantage plan or a prescription drug plan through a private insurance company. It is important to research and compare different plans to determine which will offer the best coverage and costs for your specific needs. Overall, enrolling in Medicare is a crucial step in securing reliable healthcare coverage for yourself or a loved one.

How to Apply for Medicaid

Applying for Medicaid can be confusing, but it’s an important step in getting the medical care you need. Medicaid is a government-funded health insurance program for low-income individuals and families, and it provides coverage for a wide range of services, including doctor visits, hospital care, and prescription drugs.

To apply for Medicaid, you’ll need to gather some basic information about your income, assets, and family size. You can do this by contacting your state’s Medicaid agency or visiting their website. You may also be able to apply in person at a local office.

Once you’ve submitted your application, it will be reviewed to determine if you’re eligible for Medicaid. This process can take several weeks, so it’s important to apply as soon as possible if you need health insurance.

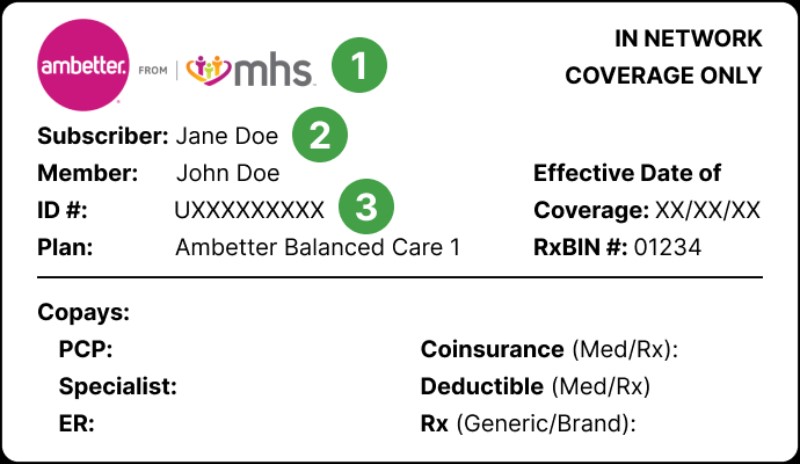

If you’re approved for Medicaid, you’ll receive an insurance card that you can use to access medical services. You’ll also need to choose a primary care doctor who will coordinate your care and help you find specialists as needed.

Overall, Medicaid can be a lifesaver for people who can’t afford traditional health insurance. By understanding the application process and knowing what to expect, you can take control of your health care and get the treatment you need to stay healthy.

Ambetter Plans and Pricing for Medicaid

Ambetter offers a variety of Medicaid plans with different pricing options. The costs of these plans are determined by factors such as income, family size, and location. These plans provide coverage for essential health benefits including preventive care, emergency services, and prescription drugs. To find out more about Ambetter’s Medicaid plans and pricing, you can visit their website or contact their customer service team. It is important to compare the costs and benefits of these plans to ensure you choose the one that is right for you and your family.

Ambetter Medicare Plans: Benefits and Costs

If you’re considering Ambetter as your Medicare insurance provider, it’s important to understand the benefits and costs included in their plans. Ambetter offers several plan options for Medicare beneficiaries, including HMO and PPO plans. Some of the benefits included in these plans may be lower out-of-pocket costs for prescription drugs, access to a large network of healthcare providers, and preventive care services. The costs of Ambetter’s Medicare plans may vary depending on the specific plan and the state in which you live. It’s important to compare plan options and costs before choosing Ambetter as your Medicare provider.

Ambetter Medicaid: Benefits and Costs

Ambetter Medicaid is a healthcare plan designed for people with low incomes. As such, it covers a range of healthcare services, including doctor visits, lab tests, prescriptions, and hospitalizations. The specifics of what is covered will vary by state, so it is important to check with your local Ambetter office to see what services are covered.

In terms of costs, Ambetter Medicaid is an affordable option for those with limited incomes. Premiums will vary depending on your state and your income level, but they are designed to be affordable for those who qualify for the program. Additionally, most services are covered without any additional cost, so you don’t have to worry about unexpected bills piling up.

One consideration to keep in mind is that Ambetter Medicaid may have restrictions on which doctors and hospitals you can see. Before enrolling, you should check to see if your preferred healthcare providers are in the network. If they are not, you may need to switch to a provider that is covered by your plan.

Overall, Ambetter Medicaid can be a great healthcare option for those with low incomes. With affordable premiums and comprehensive coverage, it provides peace of mind that you can get the care you need without breaking the bank.

Which States offer Ambetter Medicaid and Medicare?

As of 2021, Ambetter offers Medicaid plans in 20 states: Arizona, Arkansas, Florida, Georgia, Illinois, Indiana, Kansas, Michigan, Mississippi, Missouri, New Hampshire, Nevada, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Washington, and Wisconsin.

Ambetter also offers Medicare plans in some of these states, although the availability varies by location. It’s important to check with Ambetter directly or speak with a licensed insurance agent in your area to determine which plans are available to you.

How to Choose Between Ambetter Medicaid and Medicare

Choosing between Ambetter Medicaid and Medicare can be a difficult decision. It is important to understand the differences between the two programs in terms of benefits, costs, eligibility, and coverage options. Medicaid is a government-funded program that provides health coverage for low-income individuals and families, while Medicare is a federal insurance program that covers people over the age of 65 and those with certain disabilities.

When deciding between Ambetter Medicaid and Medicare, it is important to consider your current and future health care needs. If you are under 65 and have low income, Medicaid may be the better option for you, while Medicare may be more suitable if you are 65 or older and have greater medical needs. You should also consider the costs associated with each program, such as premiums, deductibles, and out-of-pocket expenses.

To make the best decision for your healthcare needs, research your options and speak with a healthcare provider or insurance agent. They can help you understand the different coverage options and eligibility requirements for Ambetter Medicaid and Medicare, and guide you in choosing the right plan for you.

Ambetter Medicaid and Medicare: Frequently Asked Questions

Q: What is the difference between Medicaid and Medicare?

A: Medicaid is a state-run program for low-income individuals and families, while Medicare is a federal program primarily for those over 65 or with certain disabilities.

Q: Is Ambetter insurance a Medicaid plan?

A: Ambetter offers both Medicaid plans and Medicare plans, as well as plans through the Health Insurance Marketplace.

Q: What are the benefits of Ambetter Medicaid plans?

A: Benefits may vary by state, but typically include coverage for doctor visits, hospital stays, prescription drugs, and preventative care.

Q: What are the benefits of Ambetter Medicare plans?

A: Benefits may vary by plan, but typically include coverage for hospital stays, doctor visits, and prescription drugs.

Q: How do I enroll in Medicare?

A: You can enroll in Medicare through the Social Security Administration.

Q: How do I apply for Medicaid?

A: You can apply for Medicaid through your state’s Medicaid program.

Q: How do I choose between Ambetter Medicaid and Medicare?

A: Consider your eligibility, healthcare needs, and budget when deciding between these two options.

Q: Which states offer Ambetter Medicaid and Medicare plans?

A: Ambetter plans are available in multiple states, but availability varies by plan and location.

Q: What are the costs associated with Ambetter Medicaid and Medicare plans?

A: Costs vary by plan and location, but may include premiums, deductibles, copays, and coinsurance.

Q: Is Ambetter a good choice for insurance?

A: Ambetter may be a good choice for those who qualify for Medicaid or are looking for affordable options through the Health Insurance Marketplace. However, it’s important to compare plans and costs before making a decision.