Today bringing a very important topic for all those who start a project like independent or freelance.

In itself, taking the first step may seem impossible for more than one of us, the terror of facing the uncertainty of getting clients, administrative procedures, carrying out work, dealing with all aspects of a business, mainly taxes and accounting. Now let’s imagine that we do not know how much we will charge for the work to be done, charge cheaply, have many clients and still not reach us or charge dearly but without a soul to hire us.

In itself, taking the first step may seem impossible for more than one of us, the terror of facing the uncertainty of getting clients, administrative procedures, carrying out work, dealing with all aspects of a business, mainly taxes and accounting. Now let’s imagine that we do not know how much we will charge for the work to be done, charge cheaply, have many clients and still not reach us or charge dearly but without a soul to hire us.

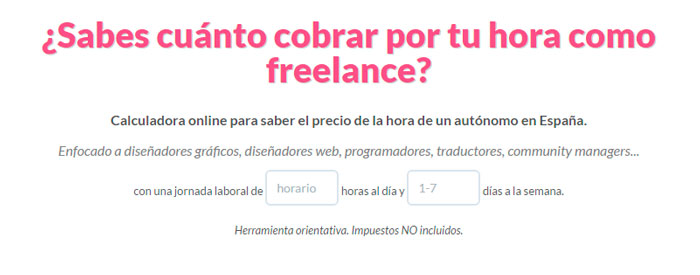

To help us in the process the agency Cosmonaut has made a tool that can give us an idea of what we need to charge per hour in order to cover our basic needs, as well as Laura Lopez does his thing with a tool for our Spanish friends.

How much do you want to earn per month?

I know that you and I want to earn as much as possible always, but let’s be realistic about how much you need to cover your needs. If you need housing, clothing, food, credit card responsibilities, mortgage or loans. Well, if it’s your first time at least you could go for the number you currently earn, right? It sounds logical because to be better as an independent you must at least earn what you earn as a worker for a company, although the idea is to earn more.

How many days off do you want to have per year?

Regardless of the weekends that I recommend you always occupy them to be able to be with the family, girlfriend, wife, children, relatives, associates, etc. These we can say that they are the days of vacations and the bridges that they give by law we can go to any legislative site of each country, in the case of Mexico there are 7 the first year and then 2 days per year. It is important to do our planning in case you want to make leisure or family trips, since they must be scheduled, at least the number of days.

How many sick days do you plan to take per year?

This question is sometimes complicated by the very nature of the question, no one really wants to get sick, or go to the doctor but we can still calculate them. The easiest way is to remember, yes, although it sounds strange, memory will help us calculate these days. Do the following exercise: take two calendars, one from the immediately preceding year and the other from two years ago. Try to remember which months you got sick and from what, once you have defined the months, let’s suppose you took a day of work, count and voila, the days you need to “estimate” for sickness disabilities will appear.

What percentage of your time is administrative?

This section I think is self explanatory. The important thing is to determine that percentage, I do it in the following way and I hope it helps you determine your own. The first step is to know the number of hours we work, generally a working day is 8 hours. Subsequently, how many of them do you invest in design, code, assembly, assembly of advertisements, etc. depending on the activity you dedicate to. Once this is done, we will calculate the number of hours a day we spend serving clients, calculating taxes, issuing quotes, invoices, transferring to client meetings. Now we will simply divide the number of administrative tasks by the total hours of the day, resulting in the desired percentage.

What are your fixed monthly expenses?

Office expenses, stationery, Internet, payment of the equipment you use to do your activity, rent, electricity, water, are the most common, take an inventory of what you spend month by month, you can make averages in case some are variable or by consumption. Remember to put everything since the more information we have the better we can do our calculation.

What percentage of profit do you deserve?

Last and not least, we will have to put the percentage of profit that we will place on our work, this will help us to calculate how much money we have left after all the expenses that we defined previously and the balance point (where you have to pay your expenses only ). Please let us be honest and clear with this percentage, some professionals place between 10 and 30% depending on the added value of their work. Do a quick analysis of your latest work and enter the percentage that suits you best.

Now yes, each step explained is time to go to do the calculations in the tool, which I hope will be very useful in your venture, always remember that after your calculated profits you must take into account the taxes since the legality of your Income in any country is a sensitive issue, which can save you problems in the future.

http://cosmonauta.mx/toolbox/precioporhora.html

http://www.calculadorafreelance.com/