If you are looking to become an insurance adjuster in Florida, there are several steps you need to take. First, you need to understand the licensing requirements and the different types of adjuster licenses available. Then, you need to take the necessary steps to obtain your license, including completing pre-licensing education and passing a state exam.

Fortunately, there are many resources available to help you with the process. One valuable tool is the Florida Department of Financial Services License Lookup, which allows you to search for licensed adjusters and check the status of your own license. There are also several exam prep courses available that can help you prepare for the state exam and ensure that you pass on your first try.

It’s important to remember that the process of becoming a licensed insurance adjuster in Florida can be complex, but with the right resources and support, you can achieve your goals. Don’t be afraid to reach out to experienced professionals or take advantage of online resources to help guide you through the process.

Florida Department of Financial Services License Lookup

The Florida Department of Financial Services offers a license lookup tool for those who want to verify the status of an adjuster license. This tool allows you to search for adjuster licenses by name, license number, or National Producer Number (NPN).

Using this tool can help ensure that you are working with a licensed adjuster who has met the state’s licensing requirements. It is important to note that not all adjusters in Florida are licensed by the state. Public adjusters, for example, are not required to be licensed by the state but are regulated by the Florida Department of Financial Services.

In addition to checking an adjuster’s license status, it is also important to research their experience and reputation. You may want to ask for references, read reviews and ratings, and verify their insurance coverage before working with them.

Overall, the Florida Department of Financial Services License Lookup tool can be a helpful resource for consumers and insurance professionals who need to verify the status of an adjuster license in Florida.

FL Insurance Adjuster License Lookup Guide

Are you looking to verify if an adjuster in Florida is licensed? Our FL Insurance Adjuster License Lookup Guide provides detailed information on how to access the official license lookup tool provided by the Florida Department of Financial Services. This tool allows you to search for active and inactive adjuster licenses in the state of Florida. In addition to providing information on how to use the license lookup tool, our guide also offers tips on finding the best resources for exam prep courses, license renewals, licensing requirements, and continuing education. Read on to learn more about the process of verifying FL adjuster licenses.

Tips for Finding an FL Adjuster License Lookup Tool

When it comes to finding an FL adjuster license lookup tool, it can be overwhelming to sift through the various options available. However, there are a few tips that can help streamline your search.

Firstly, consider using the Florida Department of Financial Services License Lookup tool. This is an official resource that can provide accurate and up-to-date information about adjuster licenses in the state.

If you prefer to use a third-party tool, make sure to do your research before selecting one. Look for reviews and feedback from other users to ensure that the tool is reliable and provides relevant information.

Additionally, be aware that some tools may have limited functionalities or require a fee. Make sure to fully understand the features and costs of a tool before committing to using it.

Overall, taking the time to research your options and carefully evaluate different tools can help you find an FL adjuster license lookup tool that fits your needs.

Finding FL Adjuster License Renewal Information

If you already have a Florida adjuster license, it’s important to keep it current by renewing it before it expires. The Florida Department of Financial Services (DFS) oversees the licensing process and provides information on how to renew your license. You can renew your license online through the DFS website or by mail. Before renewing, make sure you have completed the required continuing education courses and have paid any applicable fees. It’s also important to keep track of your renewal date and start the renewal process in advance to avoid any lapses in licensure.

What You Need to Know About FL Adjuster Licensing Requirements

If you’re interested in becoming an insurance adjuster in Florida, it’s important to understand the licensing requirements. In order to obtain an FL Adjuster License, you must meet certain criteria, including completing a pre-licensing education course, passing an exam, and submitting an application and fee to the Florida Department of Financial Services. Additionally, you must be at least 18 years old, have a clean criminal background, and demonstrate financial responsibility. Understanding these requirements is the first step towards a successful career as an insurance adjuster in Florida.

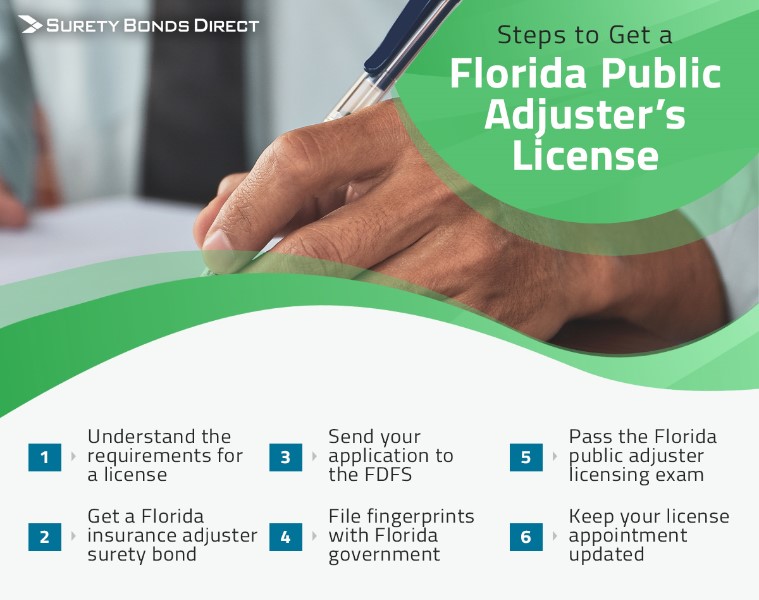

Steps to Take to Get an FL Adjuster License

If you are interested in becoming an insurance adjuster in Florida, there are several steps you will need to take to obtain your license. First, you will need to complete a pre-licensing course that is approved by the Florida Department of Financial Services. This course will teach you the basics of insurance adjusting and will prepare you for the state licensing exam.

Once you have completed your pre-licensing course, you can schedule your licensing exam. The exam covers a range of topics related to insurance adjusting, including insurance laws and regulations, ethics, and claims handling.

After passing your licensing exam, you will need to submit an application for your Florida adjuster license. You will need to provide proof of your pre-licensing course completion and your exam results, as well as a set of fingerprints for a background check.

Once your application has been approved and your license has been issued, you will be able to work as an insurance adjuster in Florida. Keep in mind that you will need to renew your license periodically and complete continuing education courses to stay current with changes in insurance laws and regulations.

Finding an FL Adjuster License Exam Prep Course :

If you’re planning to become a licensed adjuster in Florida, you’ll need to pass the state’s adjuster exam. To increase your chances of success, take an exam prep course. This section of the table of contents provides information on how to find an FL adjuster license exam prep course. A prep course can help you improve your knowledge and skills, which will give you the confidence to pass the exam. By taking a prep course, you’ll learn the types of questions you’ll face on the exam, and you’ll have the chance to practice answering them. An excellent exam prep course will also cover important topics such as insurance law, ethics, and claims handling. To find an FL adjuster license exam prep course that’s right for you, follow the tips provided in section 4.

Common Questions About FL Adjuster Licensing Answered

If you are looking to become a licensed adjuster in Florida, you likely have many questions about the process. In this section, we answer some of the most common questions about FL adjuster licensing:

- What are the requirements to become a licensed adjuster in Florida?

- How do I apply for an FL adjuster license?

- Is there an exam that I need to pass?

- What types of adjuster licenses are available in Florida?

- How often do I need to renew my FL adjuster license?

- What are the continuing education requirements for FL adjuster license renewal?

- How much does it cost to become a licensed adjuster in Florida?

By understanding the answers to these questions, you can better navigate the FL adjuster licensing process and ensure that you meet all requirements to obtain and maintain your license.

FL Adjuster Licensing Fees: What You Need to Know

Section 10 of the table of contents focuses on an important aspect of obtaining an FL Adjuster License: the fees involved. It is crucial to have a clear understanding of the costs associated with obtaining and maintaining your license in order to avoid any surprises down the road.

The section may cover topics such as the initial application fee, renewal fees, and any additional fees that may be required for things like background checks or fingerprinting. It may also provide information on any discounts or fee waivers that may be available.

Make sure to read through this section carefully and take note of any important deadlines or requirements related to fees. It is always a good idea to budget accordingly and plan ahead in order to avoid any unnecessary delays or complications in the licensing process.

Understanding the Different Types of FL Adjuster Licenses

Aspiring adjusters in Florida have the option to choose from several types of adjuster licenses. Depending on the type of license, different requirements apply. It’s important to understand the differences between the types of licenses and choose the one that best suits your career goals.

The different types of FL adjuster licenses include:

1. All-Lines License: This license allows an adjuster to handle claims for all types of insurance, including property, casualty, and health.

2. Property & Casualty License: This license is limited to adjusting claims related to property and casualty insurance.

3. Health License: This license allows adjusters to handle claims for health insurance policies.

4. Workers’ Compensation License: This license is limited to adjusting claims related to workers’ compensation insurance.

5. Public Adjuster License: This license is for individuals who wish to represent policyholders in negotiating insurance claims and settlements.

Each type of license has different educational and examination requirements, as well as fees. Make sure to research your options thoroughly and choose the license that aligns with your career goals.

If you already have an adjuster license and want to expand your expertise to cover additional areas, you may be required to complete additional coursework and examination to earn a new license type.

Overall, understanding the different types of licenses available is an important step in becoming a successful adjuster in Florida.

How to Check the Status of an FL Adjuster License

Checking the status of your Florida adjuster license is an important step for staying in compliance with the state’s requirements. Luckily, the process is relatively simple and can be done online. Start by visiting the Florida Department of Financial Services website and clicking on the “Licensee Services” tab. From there, you can choose “Licensee Search” and enter your license number or name to retrieve information about your license status.

It’s important to note that you should check your license status regularly, especially before conducting any adjuster work in the state. Keeping your license current and in good standing is crucial for maintaining your professional reputation and avoiding any legal issues. If you have any questions or concerns about your license status or renewal, don’t hesitate to reach out to the Florida Department of Financial Services for assistance.

What You Need to Know About FL Adjuster License Continuing Education

Continuing education is an important aspect of maintaining your FL adjuster license. As per the Florida Department of Financial Services, licensed adjusters must complete 24 hours of continuing education every two years. This includes:

– 10 hours of law and ethics

– 2 hours of hurricane mitigation

– 2 hours of flood insurance

– 10 hours of elective courses

Adjusters who hold an all-lines license or a public adjuster license must complete at least 5 of the elective hours in property and casualty. It is important to note that failure to complete continuing education requirements can result in a suspension or revocation of your adjuster license.

To find approved courses for continuing education, you can check with the Florida Department of Financial Services or look for providers on the National Association of Insurance Commissioners website. Make sure to keep track of your completed courses and submit proof of completion to the department before your license expiration date.