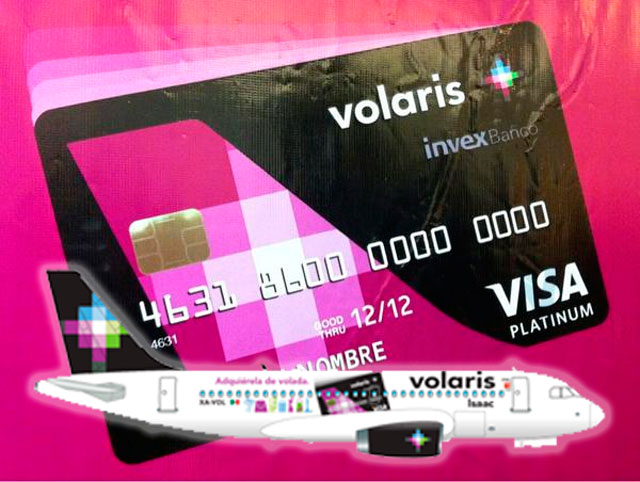

Volaris Invex It has many benefits and advantages that you can take advantage of for your vacations, do you want to know how it can benefit you and also know if it is a credit card with risks? Well then, keep reading and you will have with you all the information you are looking for before applying for the card …

Volaris invex and its benefits

As you just read it will fly invex It has many benefits, if you do not know them, below you will read how you can benefit with this credit card:

- Every time you make a purchase, you accumulate points and then use them to pay the fare for your trips on Volaris.

- When you are about to travel, you are eager to take your place quickly and reach your destination and therefore you want to board as soon as possible, because with Volaris you have priority, therefore you will be among the first to board and you will take your place quickly.

- If until now extra luggage was a problem for you with Volaris, it will no longer be a problem because you acquire authorization for extra luggage not only for you as the owner but also for your companions.

- You benefit from the menu between clouds with a 15% discount.

- When you buy on the volaris.com site you can pay your trips in installments without interest, you can choose to pay in 3, 6 and 11 months knowing that the cost will always be fixed since you will not be charged interest for your purchase in months.

- They do not charge you an interest rate for balance transfers.

Volaris invex and its risks

While these are not exactly about risk of will fly invex, they can be if you do not take into account these are important questions for your knowledge, such as:

- They will charge you $ 1700 + VAT as an annual fee for you as the owner.

- They will charge you $ 850 + VAT as an annual fee for each additional card you request.

- However, your basic card has the free annual fee in the first year.

- In the same way, if you requested additional cards, they will also have the free annual fee in the first year.

- If you need to have cash they will charge you 10%

- The weighted interest rate is 24.6% on average.

Volaris invex card

Once you know about will fly invex its benefits and risks and you want to obtain the card, you need to know its requirements, therefore pay attention:

- You need to be between 18 and 69 years old and eleven months old.

- You must have a bank credit card whose credit line is greater than $ 15,000 with a one year old on said card.

- Present proof of address.

- Submit the application with your signature.

- Present your current official identification.

Invex volaris bench

Banco invex volarís is a financial group that offers you various products and services such as investment funds, trust services, model portfolios, currencies, retirement plans, international investment, basic accounts, credit and money and capital and Invex Total.

For example, with Invex Total you diversify your investment through institutional advice in order to maintain the performance with transparency.

All this based on an analysis of the markets, evaluating the micro and macro economic conditions to execute immediately and rebalancing the portfolio according to the outlook of the moment.

- Of course, it also offers you the volaris invex card, which is a Visa platinum credit card for you as a traveler who loves to travel and wants to benefit from your purchases.

Well, when you travel to any foreign country, you have the assurance that if you lose your card or it is stolen, it will be replaced immediately.

You also travel safely knowing that it is a credit card accepted worldwide in millions of merchants and ATMs.

When you make purchases in a foreign country with your card, you benefit from 6-month payments without interest if you spend at least $ 700.

You also get the volaris purse.

How to apply for the card will fly invex online

Knowing that the first annuity is free and you also get a welcome bonus in the volarís mode as well as a v club membership, you can start processing your card, in this way:

- Login to https://www.invextardamientos.com.mx/invex/landings/Solicitala/invex-volaris/indexSolicitalaYa.html

- Complete the corresponding field with your phone number and check the box: I agree with the privacy notice.

- Click Submit.

- Click Here and complete the application to receive approval in a few seconds.

How to apply for the volaris invex card by phone

If instead of requesting the card online you prefer to request it by phone, you can also do it in the following way:

- Call the phone 01 800 036 2426 and request it instantly.

- Login to https://www.invextardamientos.com.mx/invex/landings/Solicitala/invex-volaris/indexSolicitalaYa.html and schedule a phone call by completing the form.

- Enter your name, your last name, your email address, your phone number, choose the time when they can call you either in the morning, in the afternoon or in the evening.

- Check the box I agree with the privacy notice and click submit.

- In case you have any questions, you can use the online chat in the lower right corner of the same website, just click on Chat with us and start the conversation.

- In this way, when you request the card and once it is awarded to you, you will begin to benefit from the welcome bonus of $ 1,300, the volaris purse with $ 400, the bonus on all your purchases of 1.5% and of course the first annuity at no cost.

- All your plane ticket purchases can be paid for 3, 6 or 11 months without interest.

- You will have access to the visa grand lounge.

- With your card you have priority to board.

- Remember that you have the advantage of a free extra luggage, there are 10 extra kilos in your first checked bag as well as an additional 10 kilos in your hand luggage.

Volaris invex coin purse

The wallet works like this:

- When you use the card you are accumulating 1.5% in your wallet.

- That accumulated electronic money can be spent by paying the airfare of the flight you choose with volaris, either part or all of the fare.