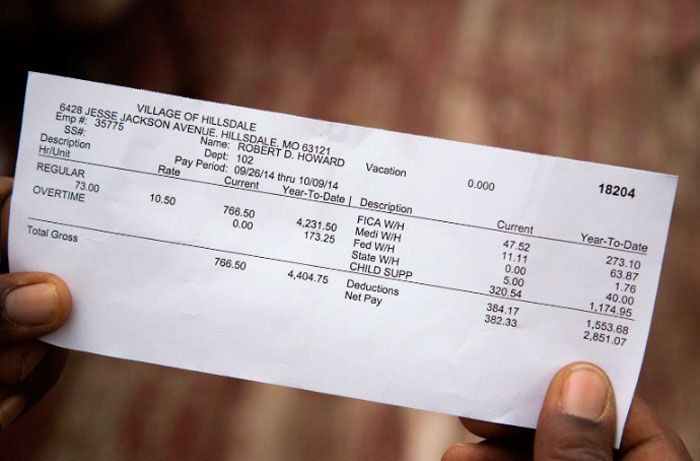

You received your paycheck for your salary and you are surprised because its amount is less than what you expected, FICA EEdid he keep part of your money?

Is it normal that you lose a part of what you expected for your work? It does not mean that you lose part of your salary, but that the salary offered by your employer is tax deductible as well as the tips you can receive and it is your obligation to report it to the federal government in the tax return.

What does FICA EE refer to?

1.Fica ee It has to do with taxes that are withheld for Medicare and Social Security, it is the Federal Tax Law, the withholding is carried out according to the type of employee you are, for example, foreign employee, resident or student.

- However, if you are a student, you do not pay Fica taxes, since the university is guided by the rules imposed by the IRS and determines the exemption from withholding for the student.

- If you want to be eligible for tax exemption fica as a student requires that you regularly attend classes and work towards the goal of taking a course of study and being incident.

- As an employee you may be eligible for the physical exception if you meet a certain number of credit hours as a part-time student as:

- You will be eligible for the physical exception if you meet 6 credit hours for an undergraduate degree, 3 credit hours for a graduate student, one credit hour for a Ph.D. candidate, one credit hour for an advanced master’s candidate if you complete courses and work on a dissertation for credit or a thesis.

They are not eligible for the FICA exemption

- If you are a full-time employee who works 40 hours a week.

- If you are a professional who works in the field of learning or science and has advanced knowledge and where the intellectual, judgment and discretion predominate.

- If you are a career employee eligible for a retirement plan, paid vacation, sick leave, if you have life insurance or tuition benefits.

- If you are an intern, resident doctor and if you are a student who is working from the beginning to the end of the academic period.

In the latter case, when that academic period has its beginning and end in a pay period, that period is eligible for the exemption.

- If you are a student registering for the next semester, you will be eligible for the fica exemption as long as the break is at least 5 weeks.

- If you are a student who works throughout the school break, for example in the summer, for an amount greater than 5 weeks, you will not be eligible if you do not attend classes during the school break.

- If you are a student, you can make all the questions you need about the physical exemption by calling 612-624-8647 or 800-756-2363.

FICA EE and non-resident foreigners

If you are a student or academic who is temporarily in the United States and has a Q-1, M1, J1 or F-1 visa, you will be exempt from taxes fica ee.

According to the IRS tax code and according to its section 7701 (b) you must be a non-resident to enjoy the exemption therefore you must:

- Be the holder of a J-1 and F1 student visa in the first five calendar years.

- Be a fellow with a J1 visa corresponding to foreign doctors, researchers and professors in the first two calendar years.

- But it will not apply to spouses and children with a Q-2, M-2, J-2 and F2 visa.

- Under section 7701 (b) of the Internal Revenue Code, the exemption does not apply to nonresident aliens who became resident aliens for tax purposes.

- It does not apply if you are a resident alien who changed to another visa status other than Q-1, M-1, J-1 or F-1.

Keep in mind that the period of the calendar year according to what the IRS considers does not mean the 12 months of the year consecutively but begins on January 1 and ends on December 31, no matter at what time of the year you entered the country.

What is OASDI?

OASDI is Social Security taxes like disability insurance, survivor insurance, and is a withholding tax on gross income that is subject to a different wage limit each year. However, Medicare does not have a limit on your withholding.

What does FICA mean

Federal Insurance Contribution Act is FICA, the federal tax payroll of the United States aimed at employers and employees for the financing of social security and Medicare as federal programs that provide benefits to children of deceased employees, disabled people and retirees .

The insurance also offers funds directed to the health care system, institutions that provide care to employees who lack health insurance and therefore cannot afford health treatment.

In this way they obtain social security benefits such as:

- OASDI: disability and survivors insurance, old-age insurance.

- Medicare that includes hospital insurance for the elderly.

- During your entire working career, you pay payroll taxes, which is associated with the annuity of the social security benefits that you will receive at the time of retirement.

- For this reason its definition defined as a tax is disputed because from this you obtain a right to collect in the future.

- However, most define it as a tax that is made up of Medicare and Social Security that are deducted as regulated by federal law.

- While paying the social security tax you get benefits for your retirement, for your dependents, for disabled people, Medicare provides medical benefits to people over 65, people unable to work and their dependents and retired workers.