The often intimidating, but critical part of starting a small business is learning about the “number” side of the business. You may have a great product, unique concept, and personality galore, but if you don’t have a basic understanding of business accounting, the business may be doomed before it has a chance to take off.

Having a glossary of accounting terms in your head before starting the business is important so that you can write a coherent business plan, both for yourself and to present to potential investors or lenders. The following glossary of accounting terms will help you get started.

Accounting terms

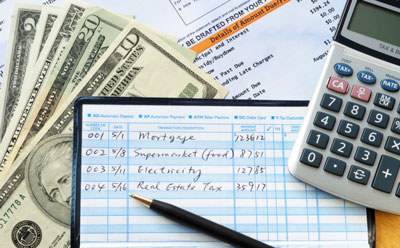

Bookkeeping It is the actual record of all business operations, including sales, expenses, and income.

Accounting it is essentially a financial statement of your business that is made by analyzing your accounting information (accounting encompasses accounting bookkeeping – you need to keep good books to have proper accounting). Accounting informs you of your current financial situation and can forecast where the business is headed financially.

Accounting it is essentially a financial statement of your business that is made by analyzing your accounting information (accounting encompasses accounting bookkeeping – you need to keep good books to have proper accounting). Accounting informs you of your current financial situation and can forecast where the business is headed financially.

Accounting periods are the regular periods in which profit and loss are calculated. Typical periods are monthly, quarterly, and yearly.

A Ledger it is the physical accounting record (now largely done with computer software) of a business. It will include assets, liabilities, income, expenses, and gains and losses. The Ledger serves as the basis for various financial reports related to the business.

The double accounting entry (must and have) is an accounting system in which each transaction is recorded twice as a debit and as a credit.

A balance it is a statement of a business “at any given time” that lists the assets, liabilities, and capital of the business. The assets must be at least equal (balance) to the liabilities and capital of the company.

Fixed costs they are costs that do not change as the business rises or falls. Fixed costs include rent, wages that are not based on performance or volume, and interest.

Variable costs they are costs that change according to changes in turnover. Examples of variable costs include the cost of labor, material, or overhead.

The cash method It is an accounting method in which expenses are recorded when the invoice is actually paid and income is recorded when the money is actually received. For example, if you make a sale on January 1 but do not receive payment until March 1, according to the payout method, it is recorded as income on March 1.

The accrual method It is an accounting method in which expenses and income are recorded at the time of the actual transaction. So if you make a sale on January 1, you record the transaction that day (the date the sale accrues), it doesn’t matter when you actually receive the payment.

Accounts payable they are amounts that the business owes suppliers and vendors for anything the business has purchased from them.

Accounts receivable are amounts that customers owe the business.

A business plan It is a written document that lists the assets and liabilities of a company and outlines a mission statement for the company, as well as a specific plan for the creation and growth of the business. It can be used to attract investors and lenders, as well as a guide to the business owner as the business gets going.

The point of balance This is where income exactly equals expenses. It is part of a business plan and tells the owner and potential investors how many sales it takes to be profitable.

An audit it is a systematic review of your financial records. Although audits are associated (not pleasantly) with the IRSThey are often carried out internally or by a third party to verify accuracy.

Net worth It is the participation of the owner of a company.

- An amortization It is a reduction in the valuation of a fixed asset. It is done when an asset has lost something but not all of its value.

- A cancellation it is a complete reduction in the valuation of a fixed asset. It is done when an asset has lost all its value.