The medically needy share of cost program is designed to help individuals who do not meet the income requirements for Medicaid, but who still need assistance with medical expenses. Essentially, this program requires individuals to pay a certain amount of their medical costs out-of-pocket each month before Medicaid benefits kick in. This amount is known as the “share of cost.”

The requirements for medically needy share of cost can be complex, and it’s important to understand what is needed to qualify for this program. Generally, individuals must have income that falls below a certain threshold and must also have high medical expenses that they cannot afford on their own. Additionally, there may be other eligibility requirements, such as residency and citizenship status.

Enrolling in a medically needy share of cost program can be a complicated process, but it’s worthwhile for those who need assistance with medical expenses. It’s important to work with a qualified healthcare provider or Medicaid specialist to determine eligibility, calculate share of cost amounts, and navigate the enrollment process. Additionally, it’s essential to understand the difference between medically needy share of cost and Medicaid, as well as the benefits and potential drawbacks of this program.

Understanding the requirements for medically needy share of cost

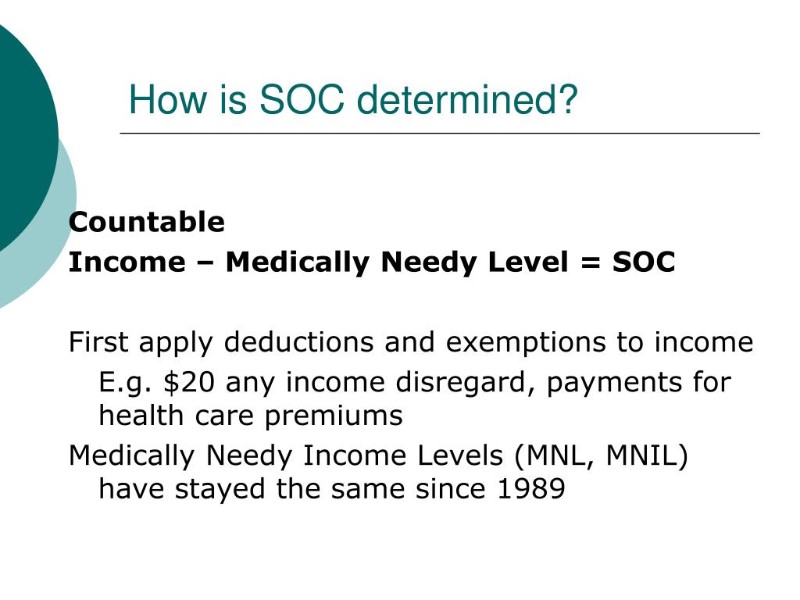

To qualify for a medically needy share of cost program, an individual must meet certain income requirements and have medical expenses that exceed a certain amount each month. The share of cost amount is determined based on the individual’s income and expenses, and must be paid out of pocket before Medicaid benefits begin.

It is important to note that not all states offer medically needy share of cost programs, and even within states that do, the requirements and benefits may vary. It is recommended to check with your state’s Medicaid office to determine if you are eligible for a medically needy share of cost program and to learn about the specific requirements in your area.

While medically needy share of cost programs can provide assistance with medical expenses for those who may not qualify for traditional Medicaid, it is also important to consider the potential drawbacks, such as the requirement to pay out of pocket before benefits begin and the potential for higher share of cost amounts based on income and expenses. It is recommended to weigh the benefits and drawbacks carefully before enrolling in a medically needy share of cost program.

Who is eligible for medically needy share of cost?

To be eligible for a medically needy share of cost program, an individual must meet certain income and medical expense requirements. Generally, those who have high medical expenses but do not qualify for traditional Medicaid due to their income level may be eligible for medically needy share of cost. The specific eligibility criteria may vary by state, so it’s important to research the requirements for your area. Additionally, certain groups, such as children, pregnant women, and individuals with disabilities, may have different eligibility rules. It’s important to consult with a Medicaid or medically needy share of cost specialist to determine if you are eligible for the program.

How to enroll in a medically needy share of cost program

Enrolling in a medically needy share of cost program is a step-by-step process that can vary depending on the state you live in. Typically, you will need to complete an application and provide proof of income and expenses. In some states, you may need to visit a local Department of Social Services office to apply in person. Additionally, you may need to renew your enrollment annually or as required by your state. It is important to research the specific requirements for your state and to seek assistance from a social worker or enrollment specialist if needed. Once enrolled, you will be responsible for paying your share of medical costs up to the designated amount. It is important to understand your share of cost amount and how it may impact your budget and healthcare decisions.

The Difference Between Medically Needy Share of Cost and Medicaid

Medicaid is a federal program that provides health coverage to low-income individuals and families. Medically needy share of cost, on the other hand, is a program that requires individuals to pay a certain amount of their medical expenses each month before Medicaid coverage kicks in. Essentially, medically needy share of cost is a way for individuals who don’t quite meet the income requirements for Medicaid to still receive coverage by contributing financially. While both programs aim to provide healthcare coverage to those in need, there are significant differences in how they operate. It’s important to understand these differences when considering which program is right for you.

What medical expenses are covered under medically needy share of cost?

Under medically needy share of cost, all medical expenses covered under Medicaid are also covered. This includes services such as doctor visits, hospitalizations, prescription drugs, medical equipment, and more. However, it’s important to note that the expenses only qualify if they are related to the medical condition that qualified the individual for the program in the first place. For example, if an individual was approved for medically needy share of cost based on a specific condition, only medical expenses related to that condition will be covered. It’s important to consult with the program guidelines to fully understand what medical expenses are covered under medically needy share of cost.

Is medically needy share of cost available in all states?

Yes, the medically needy share of cost program is available in all states. However, the eligibility requirements and the coverage may vary from state to state. It is important to check with your state’s Medicaid or social services office for more information on the program’s availability and requirements.

How to calculate your medically needy share of cost amount

The medically needy share of cost amount is the amount that a person has to pay before they can start receiving Medicaid benefits. To calculate your medically needy share of cost amount, you need to add up all your medical expenses for the month and subtract the income that is exempt from the calculation. The remaining amount is your share of cost.

For example, if your total medical expenses for the month are $1,500 and your exempt income is $400, your share of cost would be $1,100. Once you pay this amount, you will be eligible to receive Medicaid benefits for the rest of the month.

It is important to note that the medically needy share of cost amount is recalculated every month based on your current medical expenses and income that is exempt from the calculation. This means that your share of cost can change from month to month.

If you need help calculating your medically needy share of cost amount or have questions about the program, you can contact your local Medicaid office for assistance.

What are the benefits of medically needy share of cost?

Medically needy share of cost programs provide benefits to those who would not otherwise qualify for Medicaid due to their higher income. It allows individuals to have access to necessary healthcare services without incurring high out-of-pocket expenses. Additionally, medically needy share of cost allows individuals to maintain their independence by not having to rely on family or friends for financial support for medical expenses. It also offers a safety net in case of unexpected medical emergencies or ongoing conditions requiring extensive medical treatment. With the help of medically needy share of cost programs, individuals can receive the medical care they need without worrying about the financial burden.

The Disadvantages of Medically Needy Share of Cost Program

While the medically needy share of cost program can provide important benefits to those in need of healthcare, there are also a number of downsides to consider. One of the biggest disadvantages is that individuals must meet their share of cost before they can receive coverage for healthcare services. This means that they may have to pay out of pocket for a significant portion of their medical expenses, which can be a burden for many families.

Another drawback to the medically needy share of cost program is that it may be difficult for individuals to navigate and understand. There are a number of requirements and rules that must be followed in order to qualify for the program, and it may be difficult to determine exactly how much a person will need to pay in order to meet their share of cost.

Finally, the medically needy share of cost program may not be available in all states or for all healthcare services. This can limit the options available for individuals who need assistance with medical expenses.

Overall, while the medically needy share of cost program can provide valuable assistance to those in need, it is important to carefully consider the potential drawbacks before enrolling.

Can you switch from Medicaid to medically needy share of cost?

Yes, it is possible to switch from Medicaid to medically needy share of cost. However, you need to meet the eligibility requirements for medically needy share of cost and submit an application for the program. You may need to provide additional information, such as proof of income and medical expenses, in order to determine your share of cost amount. It is important to note that switching to medically needy share of cost may not always be beneficial, as you will be responsible for paying a certain amount of your medical expenses each month before your coverage kicks in. It is recommended that you carefully consider your options and consult with a healthcare professional before making any changes to your coverage.

What happens if you don’t meet your medically needy share of cost requirements?

If you do not meet your medically needy share of cost requirements, you may lose your eligibility for the program and will need to reapply. It is important to keep track of your income and medical expenses, as failing to meet your share of cost can result in denied claims and medical bills piling up. If you are struggling to meet your share of cost, consider reaching out to your state’s Medicaid agency for assistance or looking into alternative healthcare programs that may better suit your financial situation.

How to appeal a decision regarding medically needy share of cost

If your application for a medically needy share of cost program is denied or you disagree with a decision made regarding your program, you have the right to appeal. The first step in the appeals process is to request a fair hearing. This is a formal review of your case by an impartial hearing officer.

To request a fair hearing, you must submit a written request to the Medicaid agency or the Department of Health and Human Services in your state within a specified time period, typically 30 days from the date of the denial or decision. The request should include your name, address, phone number, and a brief statement outlining why you disagree with the decision.

Once your request is received, a hearing will be scheduled and you will be notified of the date, time, and location. You have the right to represent yourself or have someone represent you, such as a friend, family member, or lawyer. During the hearing, both you and the state agency presenting your case will have the opportunity to present evidence and witnesses.

After the hearing, the hearing officer will issue a written decision within a specified timeframe, typically 60 days. If you are still dissatisfied with the decision, you may have additional avenues for appeal, such as requesting a review by the state Medicaid director or filing a lawsuit in court.

It is important to remember that you have the right to appeal any decision made regarding your medically needy share of cost program. Don’t be afraid to exercise this right if you believe a decision is unfair or incorrect.