The first section of the table of contents delves into the often-overlooked topic of tax implications for family caregivers. It is important to understand that caring for a family member in need can come with not only physical and emotional tolls but also financial ones, including tax consequences.

The section attempts to answer some critical questions for caregivers to better navigate the tax landscape. It includes discussions on whether or not caregiver income is taxable, what tax obligations family caregivers may have, what tax tips to consider, and the tax benefits and consequences of being a family caregiver.

As a caregiver, being aware of these issues can help alleviate unnecessary stress and financial challenges. It is essential to be informed of the tax laws that apply to your unique situation. The section’s comprehensive approach to addressing this topic is an excellent resource for anyone who is serving as a family caregiver. It offers insights that can help you plan your finances, maximize tax benefits, and avoid potential penalties.

Is Caregiver Income Taxable? A Comprehensive Guide

As a family caregiver, it is important to understand the tax implications of your role. One of the most common questions is whether or not caregiver income is taxable. The short answer is yes. Any income earned as a caregiver, including payments from a family member or government program, is considered taxable income and must be reported on your tax return.

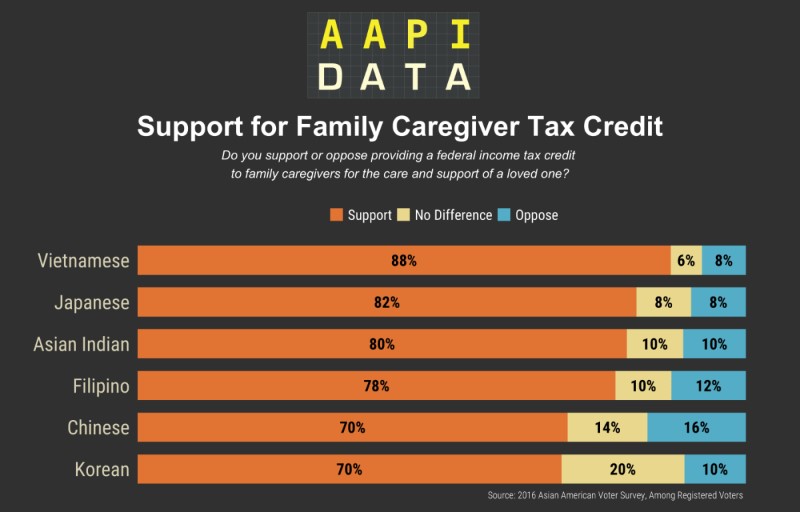

However, there are certain deductions and credits that may be available to help offset the tax burden. For example, if you are providing care for a family member with a disability, you may be eligible for the Disability Tax Credit or the Caregiver Amount. It is important to consult with a tax professional to ensure that you are taking advantage of all available deductions and credits.

Additionally, if you are receiving income from a government program such as Medicaid or VA benefits, the tax treatment may vary depending on the specific program and the type of care you are providing. Again, it is recommended to seek guidance from a tax professional to ensure that you are properly reporting all income and taking advantage of any available deductions or credits.

In conclusion, while caregiver income is taxable, there are options available to help minimize the tax burden. It is important to stay informed and seek professional guidance to ensure compliance with tax laws and regulations.

Taxes and Caregiving: What You Need to Know

As a family caregiver, it’s crucial to understand the tax implications of your role. There are various tax rules and regulations that apply to caregivers, and it’s important to know what you’re responsible for to avoid any issues with the IRS.

Some key points to consider include whether your caregiver income is taxable, what deductions you may be eligible for, and how to properly report your income and expenses on your tax return. Additionally, you’ll want to be aware of any potential tax benefits or consequences of being a family caregiver.

Overall, understanding the tax implications of caregiving can be complex, so it’s essential to seek out expert guidance or resources to ensure you comply with all the rules and regulations. With the right knowledge and preparation, you can properly manage your taxes and focus on providing quality care for your loved ones.

Do Family Caregivers Have to Pay Taxes on Income?

Yes, family caregivers may have to pay taxes on their income. The IRS considers income earned from caregiving services as taxable income, just like any other type of income. However, there are some exceptions and deductions that may apply depending on the caregiver’s specific situation.

It’s important for family caregivers to understand their tax obligations and seek guidance from a tax professional if needed. Failing to properly report income can result in penalties and legal consequences.

The Tax Consequences of Being a Family Caregiver

As a family caregiver, it is important to understand the tax implications of your role. Section 5 of this table of contents covers how being a caregiver can impact your taxes. It is important to know if caregiver income is taxable and what tax benefits or consequences come with the role. It is also essential to understand your obligations as a caregiver related to taxes. This section will provide valuable information and tips for family caregivers to ensure they maintain compliance with tax laws while fulfilling their caregiving responsibilities.

Family Caregiving and Taxes: What to Expect

When it comes to family caregiving, understanding the tax implications is crucial. In this section, we will explore what you can expect in terms of taxes as a family caregiver. It is important to note that every caregiving situation is unique, and tax laws may vary depending on the state and country you reside in. However, there are some general guidelines that can help you prepare for tax season.

Firstly, it is important to know that being a family caregiver does not necessarily mean that you have to pay taxes on your income. While some caregivers may receive payment for their services, others do not. If you do receive payment, it is important to report this as income when filing your taxes.

Another aspect to consider is whether you can claim the individual you are caring for as a dependent on your tax return. This may depend on various factors, such as the individual’s income, level of support you provide, and whether they are a relative. Claiming a dependent can provide some tax benefits, such as a higher standard deduction and potential credits.

Additionally, there may be deductions and credits available to caregivers who incur expenses related to their caregiving duties. For example, you may be able to deduct medical expenses or expenses related to home modifications and accessibility. Some credits may also be available, such as the caregiver credit or the earned income tax credit.

Overall, navigating the tax implications of family caregiving can be complex, but it is important to take the time to understand your obligations and potential benefits. Seeking the advice of a tax professional or caregiver support organization can also be helpful in ensuring that you are properly prepared for tax season.

Tax Tips for Family Caregivers

If you are a family caregiver, it is important to understand the tax implications of your role. In this section, you will find helpful tips and guidance on how to navigate tax season and ensure you are fulfilling your obligations.

Some of the key things to keep in mind include whether your caregiver income is taxable, what deductions or credits you may be eligible for, and how to properly report your income and expenses. It is also important to be aware of any potential changes in tax laws that may impact family caregivers.

By staying informed and taking advantage of available resources, you can make sure you are not overlooking any tax benefits or facing any unexpected tax liabilities as a family caregiver.

What You Need to Know About Taxes and Family Caregiving

If you are a family caregiver, it is important to understand the tax implications of your role. Being aware of how caregiving affects your taxes can help you plan for the future and avoid unexpected tax liabilities. This section provides a comprehensive guide to taxes and caregiving, answering questions such as whether caregiver income is taxable and whether caregivers have to pay taxes on their income. Additionally, it offers tax tips for family caregivers and answers to common questions about taxation and family caregiving. By reading this section, you can gain a better understanding of how caregiving affects your taxes and take steps to ensure that your tax obligations are met.

Are You a Family Caregiver? Here’s What You Need to Know About Taxes

As a family caregiver, it’s important to understand the tax implications of your role. You may be wondering if you have to pay taxes on your caregiver income or if there are any tax benefits for your caregiving duties. This section of the table of contents provides answers to those questions and more. By reading through this guide, you’ll gain a better understanding of your tax obligations as a family caregiver and be better equipped to navigate the tax system. So if you’re a family caregiver, don’t skip over this section – it could save you time, money, and stress come tax season.

A Guide to Understanding the Tax Implications of Being a Family Caregiver

As a family caregiver, it is important to understand the tax implications of your role. This guide provides valuable information on the tax implications of being a caregiver, including whether or not caregiver income is taxable, what taxes you may be responsible for paying, and tax tips for managing your caregiving expenses. Understanding these tax obligations can help you better manage your finances and ensure that you are meeting all necessary tax requirements.

The Tax Benefits and Consequences of Being a Family Caregiver

Being a family caregiver can have both tax benefits and consequences. On one hand, you may be able to claim tax deductions for expenses related to your caregiving duties such as medical expenses and home renovations. On the other hand, you may also be required to report any income received from caregiving as taxable income.

It’s important to understand the tax implications of being a family caregiver in order to properly report your income and expenses on your tax return. This can help you avoid penalties or audits from the IRS.

Consult with a tax professional or do your own research to learn more about how being a family caregiver can impact your taxes. With proper knowledge and planning, you can maximize any tax benefits while minimizing the potential consequences.

Tax Guide for Family Caregivers: Understanding Your Obligations

As a family caregiver, it is important to understand your tax obligations. This guide provides comprehensive information on taxes and caregiving, including whether caregiver income is taxable and what tax benefits may be available to you. It also covers general tax tips for family caregivers and answers common questions about taxation. By understanding your obligations, you can better manage your finances and ensure that you are in compliance with tax laws.

Family Caregiving and Taxation: Your Questions Answered

If you are a family caregiver, you may have questions about the tax implications of your role. This section answers some of the most common questions caregivers have about taxes, such as whether caregiver income is taxable and what tax benefits are available to caregivers. By understanding the tax implications of caregiving, you can better manage your finances and plan for the future.