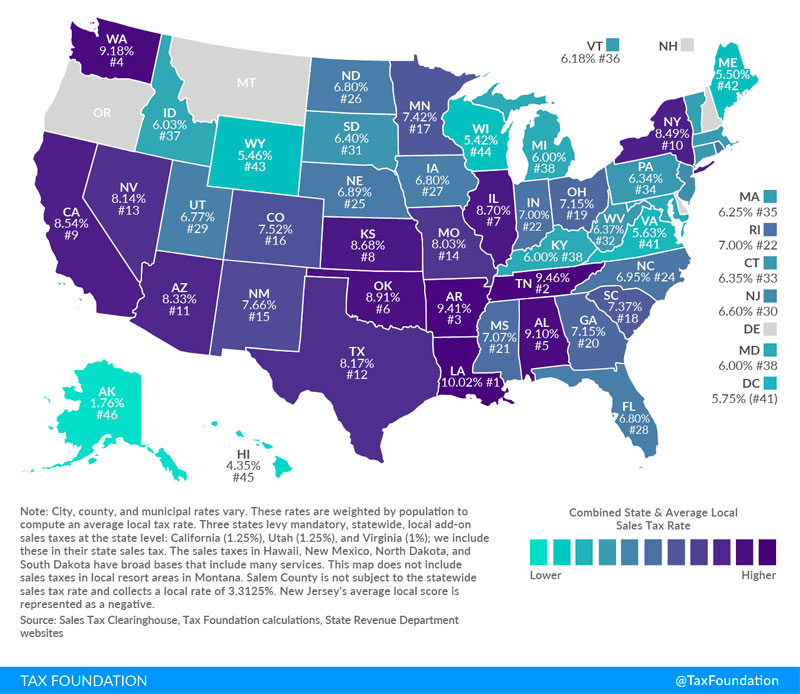

The tax table in united states corresponds to the collection of sales taxes from 45 states including the District of Columbia.

Highest U.S. tax table

The tax table in united states highest correspond to 5 states, for example the rate of Washington is 8.92%, Alabama is 9.01%, Arkansas rate is 9.30%, Tennessee rate is 9.46% and Louisiana is 9.98 %.

Anyway, the sales tax rate is different according to the state, but also based on the revenue collected from a tax that in turn affects the economy.

This difference makes consumers choose to buy products online or cross the border, as consumers also face local sales taxes that can be high.

But a state may have a moderate percentage sales tax, and a high combined state and local rate could be imposed statewide compared to other states.

Combined rates

Oregon, Hampshire, Montana, Daleware, and Alaska are the top 5 states with no state tax, but Montana and Alaska collect local sales tax.

The states with the lowest combined rates are Maine with 5.5%, Wisconsin with 5.42%, Wyoming with 5.40%, Hawaii with 4.35% and Alaska with 1.76%

State fees

At the state level, California is the state with the highest sales tax rate: 7.25%. In Tennessee, Rhode Island, and Indiana, the rate is 7%. In Colorado the sales rate is 2.9% and in Wyoming, New York, Hawaii, Georgia and Alabama it is 4%

Local rates

In New York the sales tax rate is 4.49%, in Colorado the rate is 4.60%, in Louisiana it is 4.98% and in Alabama it is 5.01%

In any case, in some California counties and cities, the combined rate increased, being for example in San José the local and state sales tax rate is 8.75% and will increase to 9.25%

Salem is a county that is exempt from a 6.875% state sales tax collection. It collects 3.4375% as a half rate so that it can compete with Daleware, as it does not collect sales tax, which indicates an average negative local rate of 0.03%

For mandatory and statewide additional sales taxes Virginia has 1%, Utah 1.25% and California 1.25%

When sales tax is not collected, it has to do with areas with a difference in the sales tax rate between two jurisdictions, since consumers in these areas make their purchases in low-tax areas such as in the suburbs such as example in Chicago avoiding a 10.25% rate for sales tax.

Similarly, companies look for areas with lower rates, as for example in New England, retail companies look for New Hampshire instead of Vermont to set up their business to avoid sales tax.

With this decision, a study indicates that sales in border counties such as New Hampshire without taxes have tripled the volume of sales since the late 1950s, but sales in border counties of Vermont remain stagnant.

In Daleware’s case, it advertises to consumers that it is a duty-free area so it can be seen from the road.

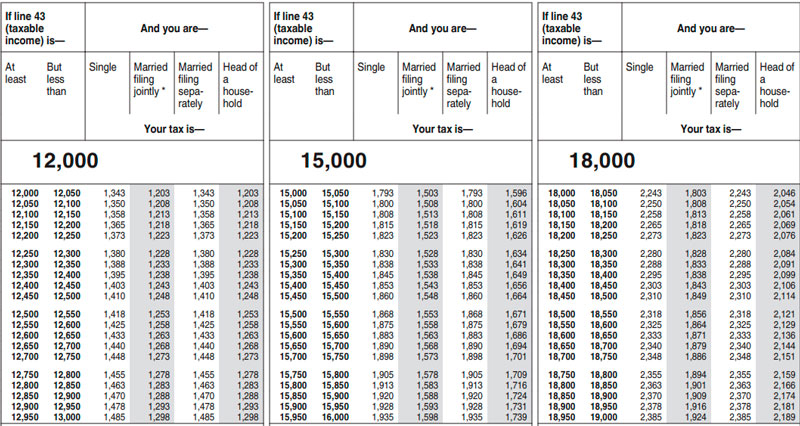

What are the tax tables and how are they used?

The tax table in united states It is a graph that shows the taxes that are owed according to the income that is received. In this way you can display a percentage rate, a discrete rate, or both rates combined.

The most typical sample is the breakpoint income level above or below that which will be applied to the various tax rates.

These tables can be found within the Internal Revenue Service website in Publication 17.

The first thing you have to take into account is the marital status in which you are. We have the following options:

Single = single

Married filing jointly = married filing jointly. Widows are also included here.

Married filing separately = married filing individual declaration

Head of a house-hold = head of the family

Even if we don’t think about it, it is important, because the standard deduction can vary according to your marital status (for example, you can deduct more money from a person who has children than someone who does not have children, because it is more difficult to support ).

With these data we calculate our taxable income. This is generally the difference between our gross income and the deductions to which we are entitled. These deductions vary according to the personal characteristics of each person. The standard deduction for our marital status is included, and the amounts of other deductions that we can apply depending on our situation (benefit, dependent family members, disabilities, …).

Once we know our taxable income, we examine in the tables the level of income at which our taxable income is. We have to take the most recent version we can find of the tax tables in IRS Publication 17.

The tables range between 1,000 and 1,000, so if we have an income for example of $ 27,678, we will go to the table of $ 27,000. Within this table, the first two columns indicate two figures: »of» (at least) and «but less than», which indicate in which row of the table our income is found. Following the example of $ 27,678, we would be in line from 27,650 but less than 27,700.

The marital status that we mentioned at the beginning, we will use it now. It’s in the top row of the table. We will take the figure that joins the column corresponding to our state and the row corresponding to our income. It is important not to make a mistake about the marital status or the amount of income, as this would lead us to a wrong number. This final amount is the amount of taxes that we must pay. In our example, assuming we are single, we would have to pay taxes of $ 3,690.

What is the tax table used for in the United States?

The tax table in the United States is used by companies with low income levels, since those with higher income including individuals instead of the tax table, use schedules of tax rates with more details and deductions.

The tables change every year with variations in status. When it comes to investors, they make sure they use the correct ones according to the area of residence and source of income.

For the payment of any tax owed or for the presentation of the federal tax return, you must understand your income tax category, the income tax rate that corresponds to you and your marital status based on the return.

Keep in mind that the taxes owed depend on the volume of income you earn and your marital status.

Marginal income

Your marginal parcel will represent the highest rate you will pay on your income. For each marital status there are marginal levels with a percentage of 10%, 15%, 25%, 28%, 3% and 35%, since these are the six levels that currently exist.

Marginal tax parity

The marginal tax parity is the tax plan that, being gradual, indicates that the higher the salary, the greater the amount of taxes you will pay and the taxable income you earn indicates your tax group.

However, only what you earn is taxed at a specific tax level. For example, if one year you earn more than the previous year and you went up to another tax category that is higher, then what you earned and entered that higher category will be taxed at the highest rate.

Therefore, assuming that you go from a 25% bracket to 28%, all your income will not be taxed at 28% but what you earn in that percentage range.

How high are the sales taxes in each state?

Average combined state and local sales tax rates, January 1, 2018.

| Condition | Tax Rate

State |

Rank | Avg. Local Tax Rate (a) | Combined Rate | Combined Rank | Max Local Tax Rate |

|---|---|---|---|---|---|---|

| (a) City, county and municipality rates vary. These rates are weighted by the population to calculate an average local tax rate. (b) Three states impose additional local, state and mandatory sales taxes at the state level: California (1.25%), Utah (1.25%), Virginia (1%), we include them in your state sales taxes. (c) Sales taxes in Hawaii, New Mexico, North Dakota, and South Dakota have broad bases that include many services. (d) Excise duties in local tourist areas are not accounted for here. (e) Salem County is not subject to the state sales tax rate and charges a local rate of 3.3125%. New Jersey average local score is represented as negative Sources: Sales Tax Clearinghouse, Tax Foundation calculations, State Revenue Department websites. |

||||||

| Alabama | 4.00% | 40 | 5.10% | 9.10% | 5 | 7.50% |

| Alaska | 0.00% | 46 | 1.76% | 1.76% | 46 | 7.50% |

| Arizona | 5.60% | 28 | 2.73% | 8.33% | eleven | 5.30% |

| Arkansas | 6.50% | 9 | 2.91% | 9.41% | 3 | 5.125% |

| California (b) | 7.25% | 1 | 1.29% | 8.54% | 9 | 2.50% |

| Colorado | 2.90% | Four. Five | 4.62% | 7.52% | 16 | 8.30% |

| Connecticut | 6.35% | 12 | 0.00% | 6.35% | 33 | 0.00% |

| Delaware | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| Florida | 6.00% | 16 | 0.80% | 6.80% | 28 | 2.00% |

| Georgia | 4.00% | 40 | 3.15% | 7.15% | twenty | 4.90% |

| Hawaii (c) | 4.00% | 40 | 0.35% | 4.35% | Four. Five | 0.50% |

| Idaho | 6.00% | 16 | 0.03% | 6.03% | 37 | 3.00% |

| Illinois | 6.25% | 13 | 2.45% | 8.70% | 7 | 4.75% |

| Indiana | 7.00% | two | 0.00% | 7.00% | 22 | 0.00% |

| Iowa | 6.00% | 16 | 0.80% | 6.80% | 27 | 1.00% |

| Kansas | 6.50% | 9 | 2.18% | 8.68% | 8 | 4.00% |

| Kentucky | 6.00% | 16 | 0.00% | 6.00% | 38 | 0.00% |

| Louisiana | 5.00% | 33 | 5.02% | 10.02% | 1 | 7.00% |

| Maine | 5.50% | 29 | 0.00% | 5.50% | 42 | 0.00% |

| Maryland | 6.00% | 16 | 0.00% | 6.00% | 38 | 0.00% |

| Massachusetts | 6.25% | 13 | 0.00% | 6.25% | 35 | 0.00% |

| Michigan | 6.00% | 16 | 0.00% | 6.00% | 38 | 0.00% |

| Minnesota | 6.875% | 6 | 0.55% | 7.42% | 17 | 2.00% |

| Mississippi | 7.00% | two | 0.07% | 7.07% | twenty-one | 1.00% |

| Missouri | 4.225% | 39 | 3.80% | 8.03% | 14 | 5.39% |

| Montana (d) | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| Nebraska | 5.50% | 29 | 1.39% | 6.89% | 25 | 2.00% |

| Nevada | 6.85% | 7 | 1.29% | 8.14% | 13 | 1.42% |

| New Hampshire | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| New Jersey (e) | 6.625% | 8 | -0.03% | 6.60% | 30 | 3.31% |

| New Mexico (c) | 5.125% | 32 | 2.54% | 7.66% | fifteen | 4.1250% |

| New York | 4.00% | 40 | 4.49% | 8.49% | 10 | 4.875% |

| North Carolina | 4.75% | 36 | 2.20% | 6.95% | 24 | 2.75% |

| North Dakota | 5.00% | 33 | 1.80% | 6.80% | 26 | 3.50% |

| Ohio | 5.75% | 27 | 1.40% | 7.15% | 19 | 2.25% |

| Oklahoma | 4.50% | 37 | 4.41% | 8.91% | 6 | 6.50% |

| Oregon | 0.00% | 46 | 0.00% | 0.00% | 47 | 0.00% |

| Pennsylvania | 6.00% | 16 | 0.34% | 6.34% | 3. 4 | 2.00% |

| Rhode Island | 7.00% | two | 0.00% | 7.00% | 22 | 0.00% |

| South Carolina | 6.00% | 16 | 1.37% | 7.37% | 18 | 3.00% |

| South Dakota (c) | 4.50% | 37 | 1.90% | 6.40% | 31 | 4.50% |

| Tennessee | 7.00% | two | 2.46% | 9.46% | two | 2.75% |

| Texas | 6.25% | 13 | 1.92% | 8.17% | 12 | 2.00% |

| Utah (b) | 5.95% | 26 | 0.82% | 6.77% | 29 | 2.65% |

| Vermont | 6.00% | 16 | 0.18% | 6.18% | 36 | 1.00% |

| Virginia (b) | 5.30% | 31 | 0.33% | 5.63% | 41 | 0.70% |

| Washington | 6.50% | 9 | 2.68% | 9.18% | 4 | 3.90% |

| West Virginia | 6.00% | 16 | 0.37% | 6.37% | 32 | 1.00% |

| Wisconsin | 5.00% | 33 | 0.42% | 5.42% | 44 | 1.75% |

| Wyoming | 4.00% | 40 | 1.46% | 5.46% | 43 | 2.00% |

| DC | 5.75% | (27) | 0.00% | 5.75% | (41) | 0.00% |